Toronto Market Update - April 2024

Posted on Apr 11, 2024

According to the Toronto Regional Real Estate Board, 6,560 homes were sold last month, marking a 4.5% decrease from the previous year's 6...

Considerations Before Buying a Home with a Pool

Posted on Apr 05, 2024

Owning your own pool comes with many perks. But before your dive in, there are responsibilities and expenses that shouldn't be overlooked. Here are 5 considerations to make before buying a home with a pool.

Weather:

Before you start to envision summer days by the pool, take a look at the climate in your area. In Canada, where weather patterns can va...What Is a Foreclosure?

Posted on Apr 05, 2024

Power of Sale

Prevalent in...Toronto Market Update – March 2024

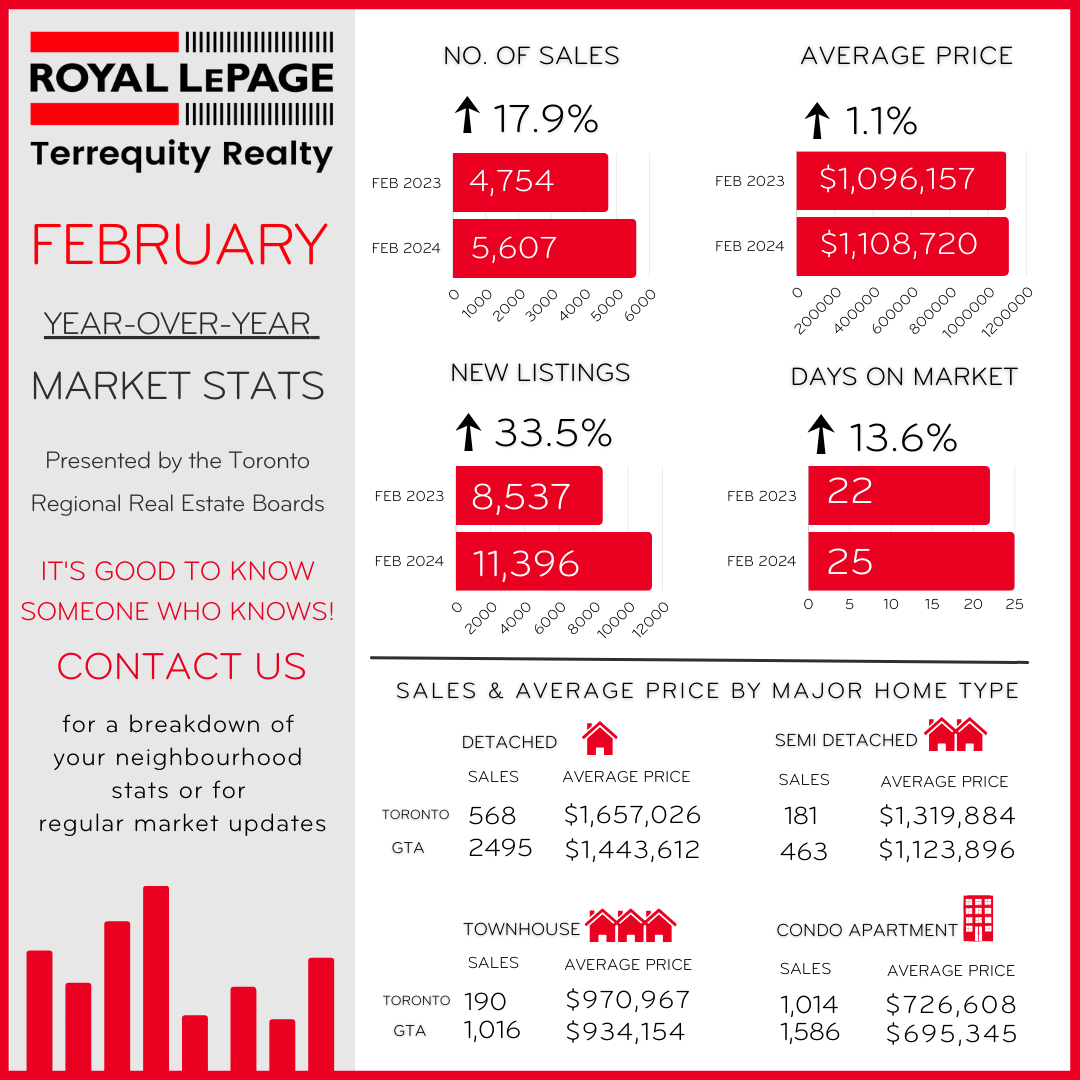

Posted on Mar 13, 2024

In February, the Greater Toronto real estate market experienced a surge in both home sales and listings compared to the previous year, as reported by the Toronto Regional Real Estate Board. The sales figures showed a notable 17.9% increase from February 2023, totaling 5,607 transactions.

The boost in sales was attributed to factors such as populatio...

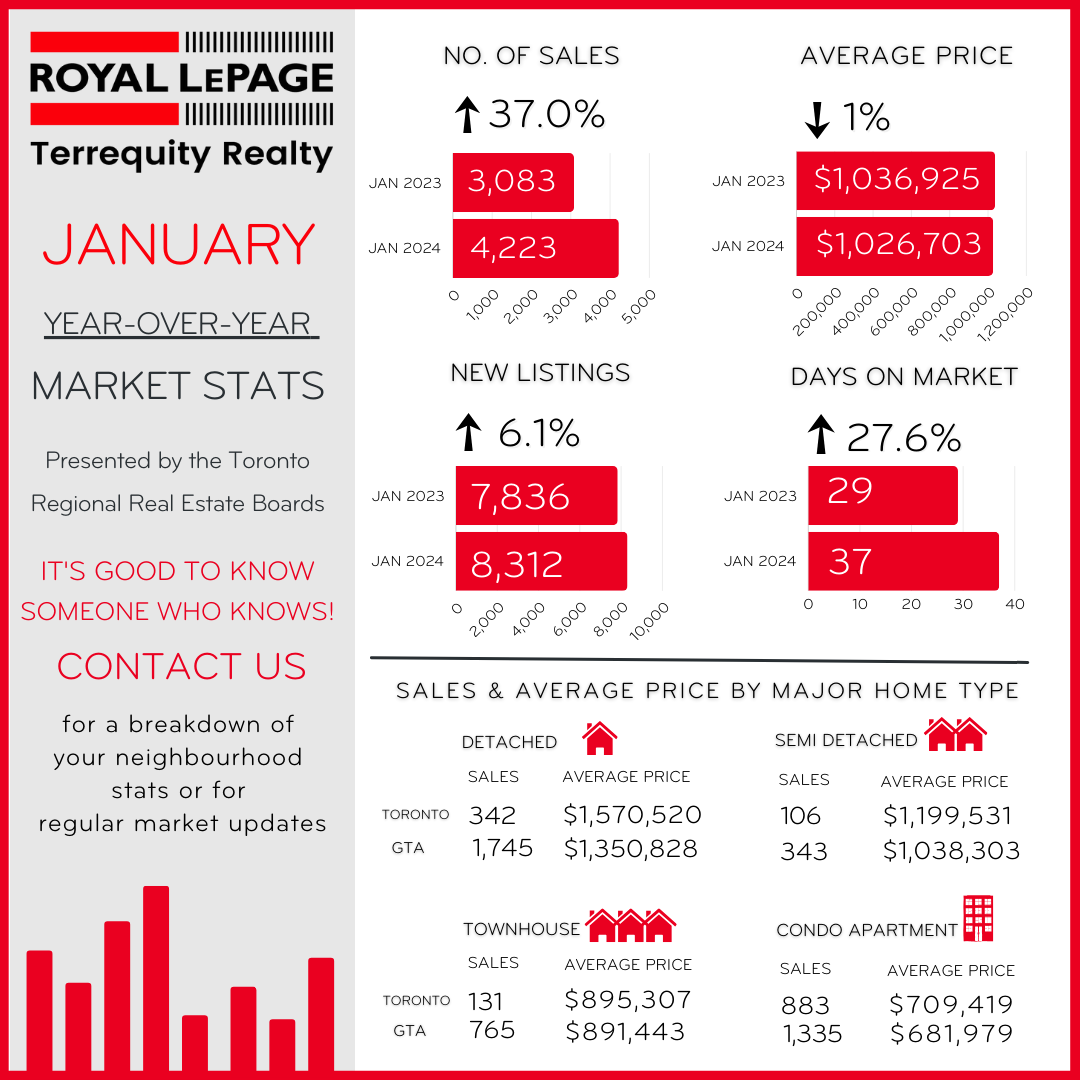

Toronto Market Update – February 2024

Posted on Feb 02, 2024

In January, Toronto witnessed a 37% surge in home sales compared to the previous year, fueled by lower fixed-rate mortgage costs. TRREB reported 4,223 sales, a 22.9% monthly increase. Despite a 6.1% rise in new listings, demand outpaced supply, tightening the market.

Sales increased across all housing types, with townhouses leading at 54.5%. Condo s...