Homebuyers in the Greater Toronto Area are seeing a shift in the real estate market this spring, with average home prices dropping and negotiating power beginning to swing back in their favour.

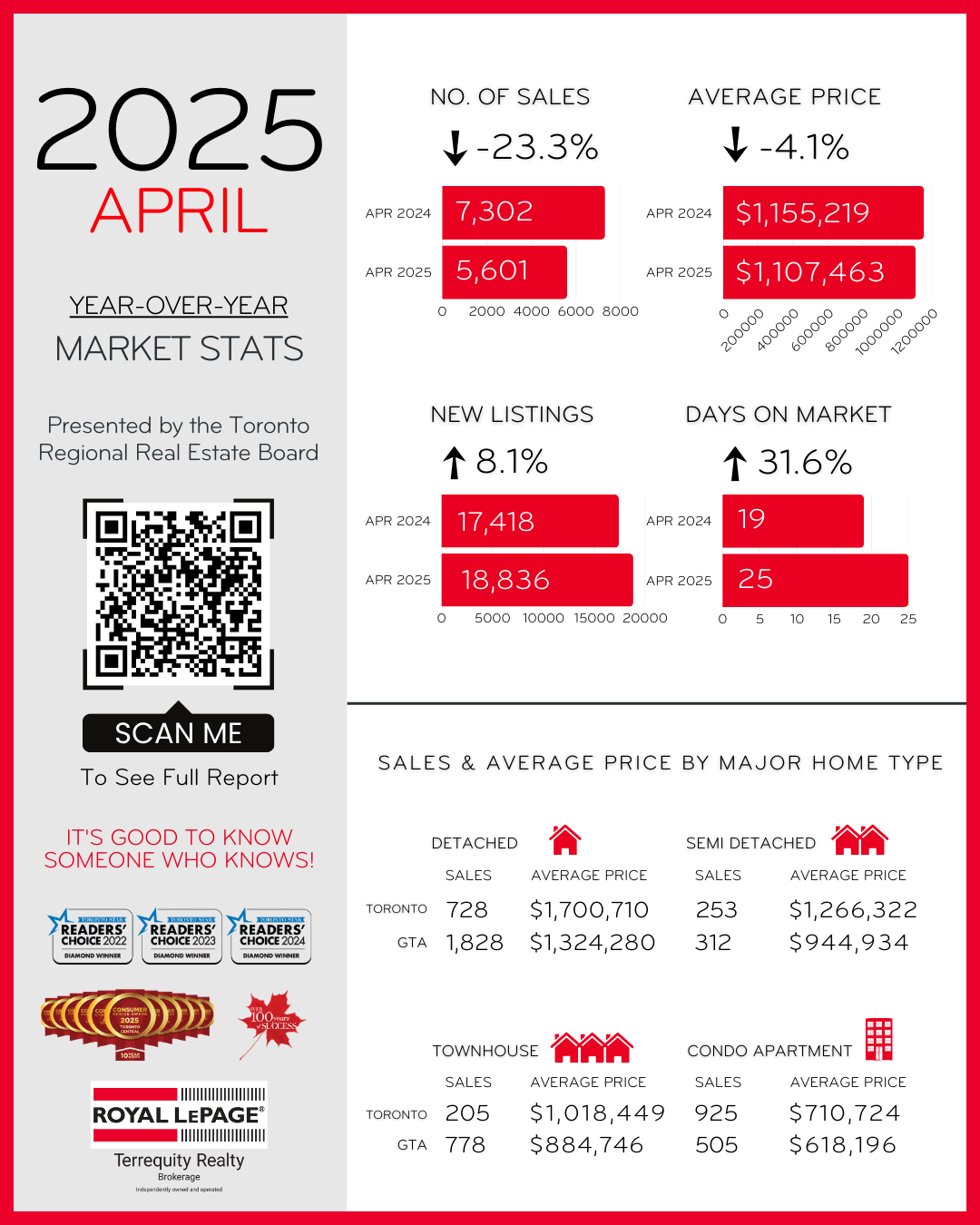

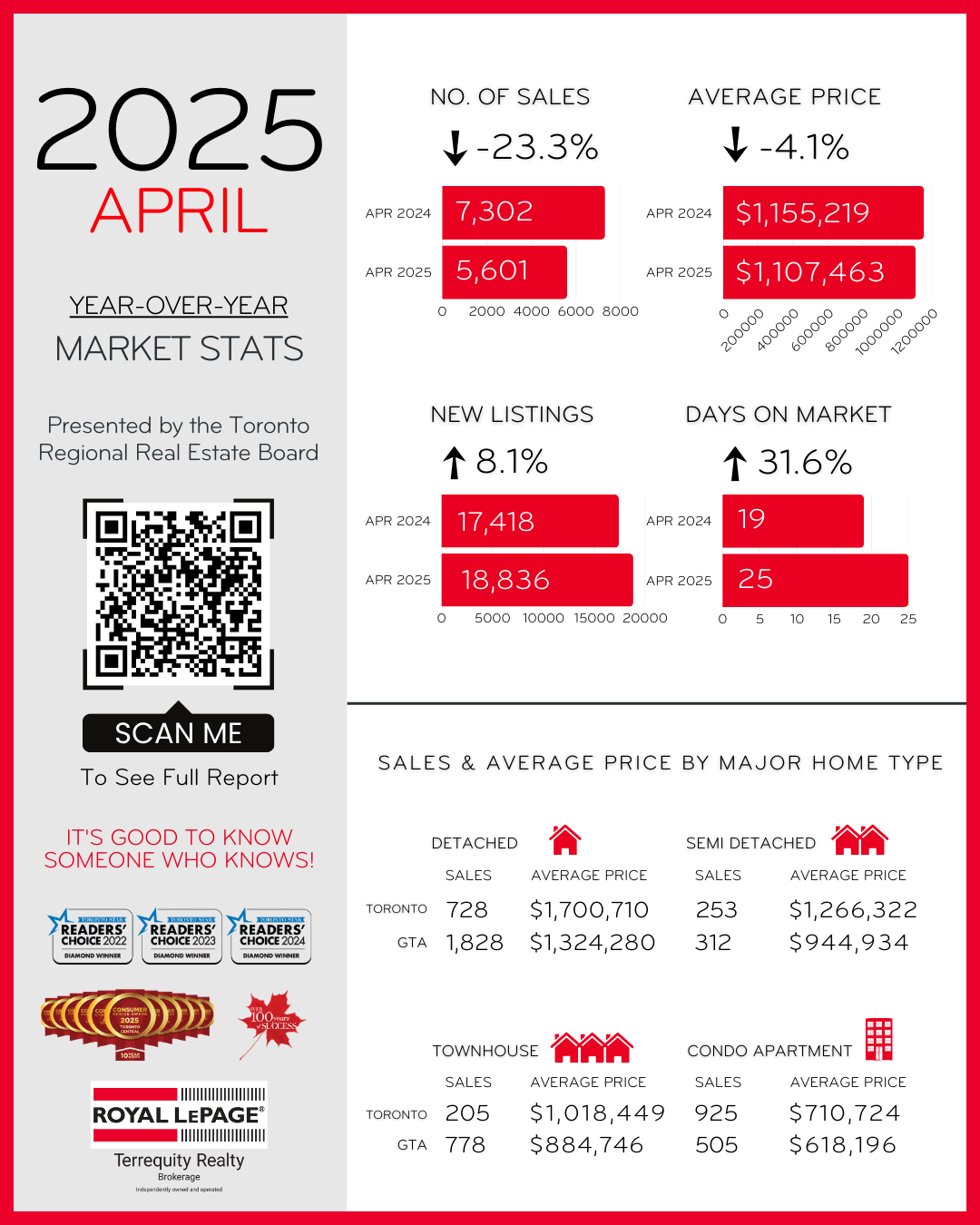

According to the Toronto Regional Real Estate Board’s latest April report, home prices across the region declined by 4.1% compared to April 2024, with the average selling price now sitting at $1.1 million. Month-over-month, prices fell 0.7%.

Sales activity saw a modest increase of 1.8% compared to March, but on a yearly basis, April sales dropped 23%. There were 5,601 home sales during the month, which represents the lowest number of April transactions since 2010, excluding April 2020 when pandemic lockdowns first began.

“The preconditions are there for recovery once we see more certainty on the economic front,” said TRREB’s chief information officer Jason Mercer. “But people are a bit uncertain about where the economy is going and where their employment situation may be heading. People are likely hesitant to entertain a large ticket until there’s more clarity.”

While new listings climbed 8.1% year-over-year to 18,836, the sales-to-new-listings ratio came in at 29.7%, which is a clear indicator of a buyers’ market.

Mercer noted that while average prices had remained relatively flat for several months, the gap between supply and demand is beginning to drive prices down: “Households looking to purchase a home have benefitted from more choice,” he said. “Selling prices are being negotiated, dragging overall pricing down. Oftentimes, it takes some time for market signals to filter through (to the greater market).”

The Bank of Canada’s decision to hold interest rates steady on April 16 has also tempered buyer expectations around lower mortgage rates.

However, for some buyers, the combination of declining home prices and stabilized borrowing costs has led to better affordability. “Lower prices coupled with lower borrowing costs translated into more affordable monthly mortgage payments,” Mercer added.

Will the market bounce back? Much of it depends on economic clarity and consumer confidence. Stay tuned to see how the spring market develops and feel free to contact me if you have any questions.